How to Integrate a Payment Gateway Into a Website?

Online payments are booming. Ready to do your business online? In this guide, you’ll learn the essentials about payment gateway integrations and processing.

Table of Contents

Back in the old days merchants traveled long miles to purchase exquisite goodies and deliver those to the buyers and make profits. Caravans used to spend months on the road.

Today, the same journey happens faster than you blink through the world web.

As long as you have a credit card, you can order to purchase pretty much anything from any location on the globe. In fact, if you live in an area with thriving online business scene, handling business with foreign partners on a global scale has become easier than ever. Trade has gone global and people definitely love it!

Table of Contents

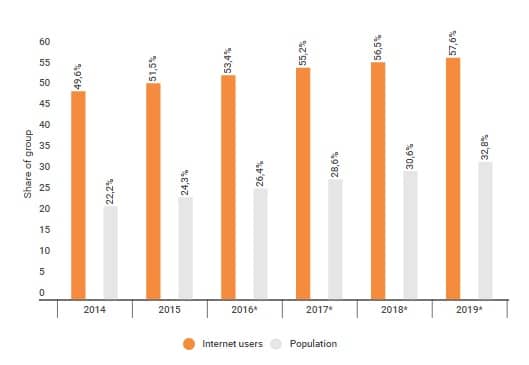

Digital Buyer Penetration Worldwide From 2014 to 2019

The following graphics illustrate how much percent of Internet users have paid online at least once versus the overall percent of population according to Statista:

By 2020 the cumulative online payments will hit $523 billion in the US only. Nearly 70% of Americans shop online on a monthly basis and 33% shop online each week. By the end of 2016, there will be 1.6 billion people who have made an online purchase at least once.

The online business ecosystem is far from going flat in the next decade, so are you ready to convert your brick and mortar business into a modern venture capable of processing financial operations online?

Considering that the answer is positive, the next question you probably have is: “But how to include a payment gateway in my website?”

This step-by-step guide will give you the exact roadmap. Let’s start with the core basics:

How a Standard Checkout Process Goes Online:

- Users are constantly paying for premium membership, advanced functionality and SaaS. Once they’ve found what they need, they want to effortlessly pay for this.

- They need to fill out respective payment information on your website to check-out and choose their preferable payment method if there are multiple options available.

- The getaway will then collect the payment information and transfer it (with secure encryption) to the processing bank of authorization.

- The processing bank will make a request through Visa’s or MasterCard’s payment network on the card. American Express and Discover authorization process is much simpler.

- The card issuer then approves/declaims the transaction or requests additional authorization from the cardholder.

- The processing bank then forwards to the response, through the getaway back to the merchant. You should finalize the transaction accordingly.

- If the transaction is successful, the merchant deposits the receipt with the processing bank.

- The payment processor then adds the funds to the merchant’s account and passes the transaction to Visa/MasterCard for a settlement.

- The card issuing company then pays the processing bank, while simultaneously taking out the funds from the card issuer’s account.

- Finally, the issuing bank adds the transaction to the cardholder’s account and requests the payment in a monthly statement (or debits the amount immediately).

So this is the invisible magic happening when a user conducts a payment online.

Payment gateways have been designed specifically to comply with all of the outline operations and authorizations and ensure that both parties (you and the user) are equally protected during the deal.

If you want to add payment gateway to website, you need to choose the most appropriate one for your business model.

Choosing The Optimal Payment Getaway: Questions To Ask First

How scalable is my payment solution?

As your business keeps booming, your payment gateway should be able to scale effortlessly as well. For instance, if you choose to launch a branded mobile app, will you be able to support in-app sales and possible subscriptions?

Stripe has some decent solutions in this case and stays on top of the game by launching innovative products all the time e.g. Relay, which allows processing payments directly from Twitter, along with a number of other apps.

Do you want customers to pay directly from your website or get redirected to the merchant?

When you setup a payment gateway on your website, you should choose among the following options:

- Payment form is integrated on your website, details go to secure payment gateway

This is the smoothest option in terms of customer experience. Standardly this is done through an API kit provided by the respective payment processor. Your form will capture all the requested details and pass them on to the payment gateway provider by calling the integrated API. This may require some additional programming, and hence increase the overall cost of payment gateway integration.

- iFrame or Redirect Payments

In this case, your customers will either get instantly redirected to a secure hosted payment page or will need to input their data in an embedded iFrame on your website. The getaway provider will notify you back through various means e.g. HTTP call back. This option takes less time to integrate for a skilled developer.

- Having an Escrow System

There’s a 3rd common payment gateway option, which suits certain business – creating secure escrow system within your platform for withholding funds before the appropriate approval is granted by the admin.

For instance, if your platform operates as a middleman in trading operations or serves as any other kind of online marketplace e.g. online bidding portal, you may want to build a dedicated on-platform depository, where the exchanged funds of the two parties will be securely stored and arbitraged while the deal is in progress.

How does this payment gateway integrate with my existing/planned integrations?

Various payment gateways have different compatibility when it comes to CRM system, accounting for instance. Ideally, to reduce the overall price of installment, your best bet is a solution, which perfectly pairs with other software you have. Alternatively, look for a service with custom APIs, which could be used by your development team.

Ok, now you should have some ideas about the various types of payment gateways out there and which may work best for your industry.

Now let’s refine the choice for online payment integration even further:

Using Your Own Merchant Account

If you wish to accept and process any kind of credit card payments, connected to a bank account, you’ll have to apply for a special merchant account with your bank, commonly known as IMA (Internet Merchant Account). Apart from banks, there are also dedicated merchant account providers you can apply to e.g. Merchant Accounts.ca.

In this case, your bank will act as an “acquirer”, which confirms the available funds, authorizes the purchase and exchanges funds with the issuing bank of the credit card (e.g. Visa, MasterCard, American Express etc.). The funds are later transferred to your merchant’s account sans the respective banking fees. Your bank will expect your website to comply with a clear set of rules and security policies (and often governmental legislation as well).

Unsecured credit cards are an option if you don’t want the hassle of dealing with a merchant account or gateway directly. Among the best unsecured credit cards for online business are those issued by American Express. Because of their high limits and no minimum balance requirements, Amex cards are great for small businesses with low transaction volumes.

So why is there so much hassle involved?

Mainly because your bank has a potential risk of losing money each time they are processing a transaction on the behalf of your business.

Both Visa and MasterCard are pretty straightforward with this:

“The cardholder is entitled to receive the promised good or service. If such good or service is not delivered then the cardholder is entitled to getting their money back.”

That’s why most banks have a strict application process in place and screen your business prior to issuing a merchant’s account. In most cases, you’ll be charged an application fee, which may be non-refundable.

Using a 3rd Party Merchant Account

Or simply put – a payment gateway offered by an independent company, which allows you to open an account and accept payments online in exchange for certain fixed fees or percentages from each sale.

The options of such website payment gateways are pretty limitless (and rather overwhelming), so here’s a quick breakdown of the most popular options:

Authorize.net

One of the oldest and most established payment processors. As they’ve been in operations since 1996, the platform is very mature, has robust functionality including fraud protection services, simple checkout options and custom integrations and subscription features. The user interface is rather friendly with easy-to-configure security features and simple customization options your developers will appreciate.

Processing Fees:

- One time $49 setup fee.

- $25 monthly getaway fee.

- $25 chargeback fee.

- Transaction fee – 2.9% + $0.30.

PayPal

Arguably the most popular payment gateway out there, especially with millennial consumers. Most buyers prefer to use it when they don’t want to give out their credit card number to yet another online portal. PayPal is usually the go-to choice for small to mid-size business and/or as an additional payment getaway for larger companies. The payment gateway integration process is simple in this case as all the necessary information is available through the Express API.

Processing Fees:

Standard PayPal and Express Checkout:

- No setup or monthly fees.

- US fees – 2.9% + $0.30 per transaction.

- International fees – 3.9% + $0.30 per transaction.

PayPal Payments Pro

- No setup fees.

- $30 monthly fee.

- US fees – 2.9% + $0.30 per transaction.

- International fees – 3.9% + $0.30 per transaction.

- Virtual terminal fees – 3.1% + $0.30 per domestic transaction; additional 1% for cross-border transactions

Stripe is somewhat like a new kid at the payment gateway yard, however, it has already earned its stripes (pun intended) as one of the most customizable and modern payment solutions. Apart from the standard payment gateway for website they also offer advanced features like accepting payments through a 3rd party app, through subscriptions or marketplace. Unlike other solutions, Stripe was built primarily with developers needs in mind, hence it’s incredibly easy to customize and adapt to your unique company needs.

Processing Fees:

- No setup or monthly fees.

- $15 chargeback or dispute fee.

- Transaction fee – 2.9% + $0.30 per transaction.

- ACH and Bitcoin processing fee – 0.8% · $5 cap

Other popular payment gateways include 2Checkout, Billdesk, WorldPay, Amazon Payments and a great array of other options including regional ones. Here’s a chart with a quick overview:

Image via PayTab.

When It’s Worth Using a Merchant Account Over Just a Payment Processor

Your payment operations go beyond $10.000/month

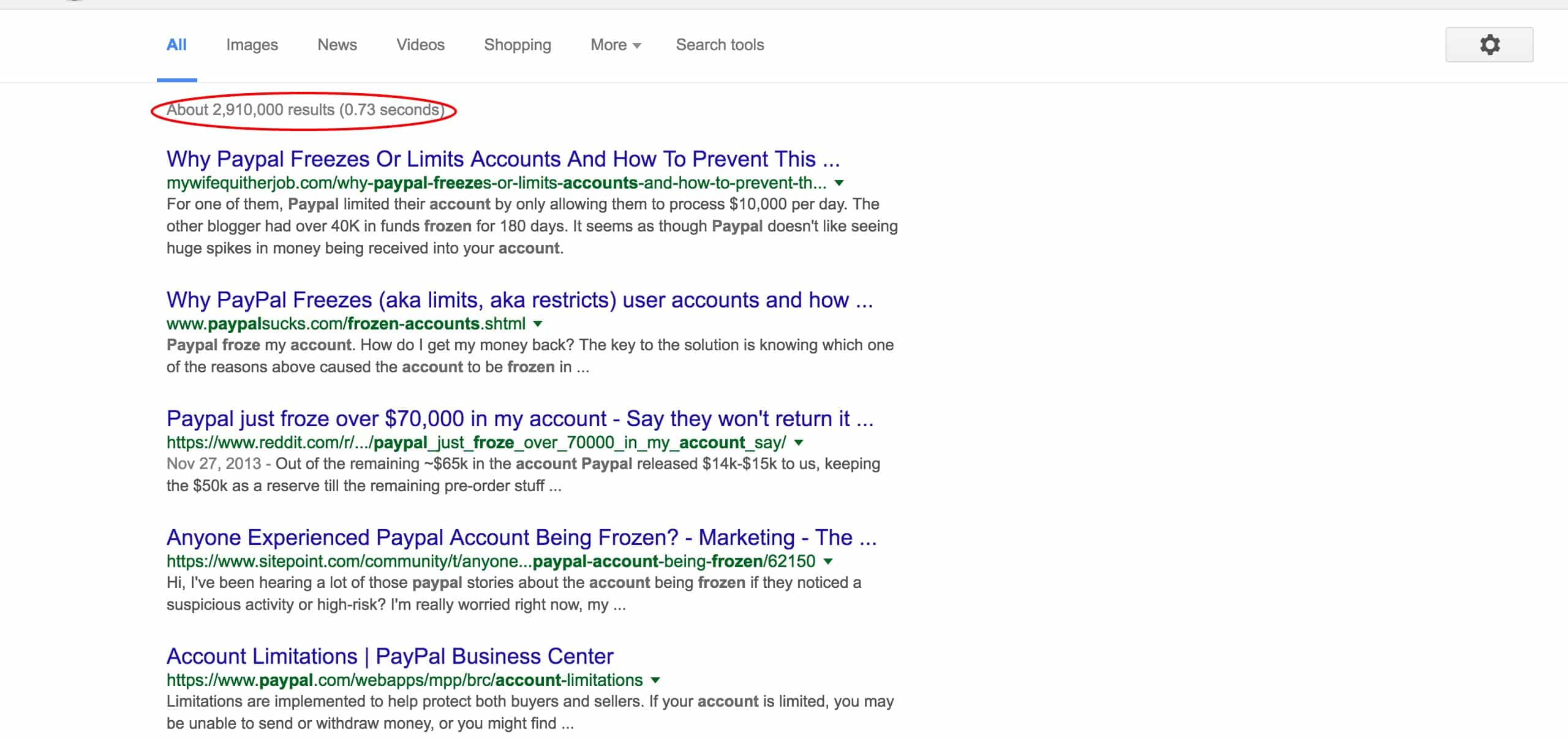

Payment processing companies have tons of clients and rarely look personally into your operations (or know your history with them) as well as your bank does. Imagine the potential damage to your business when such company decides to “freeze” your account for some reasons and you’ll have to go rounds through their faceless customer support before getting a resolution.

Additionally, Visa and MasterCard mandates independent merchant accounts, once your sales operations exceed $100.000 per year.

Lower operational risks

Yep, that’s how common the problem is with PayPal. If your operational model falls into a “High Risk” category – e.g. recurring and subscription payments, one-time transactions over $1.000, delivering products or services in the future etc. – the risk of chargebacks increases.

Unfortunately most payment processors manage those risks by suspending accounts, freezing funds or closing them all together. Not the best scenario for startup, right?

But What If I Want to Build a Custom Payment Gateway For My Business

You certainly can and Romexsoft team would be happy to help you with that as we already had experience with Building SaaS Banking Platform for FinTech Company. However, there are a few major obstacles you should consider in this case:

- A custom full-stack payment gateway will cost you $150.000 and upwards to build. A robust payment solution similar to what’s available on the market is closer to $500.000 – $800.000.

There’s a smart workaround, however, which may reduce the development costs – you can only develop the “front-end” part of the getaway, which would include the following:

- A hosted payment page.

- APIs for integrations with merchants.

- Merchant’s administrator web app/admin panel.

The pro is that you’ll now have the complete control over the technology and adapt it up to your unique operational model. Also, you’ll be able to avoid the imposed processing fees per transaction.

At the same time, however, your solution will have to pass PCI-compliance and you’ll have to find an acquirer, who will register your solution within their payment networks.

To wrap it up – the answer on how to integrate payment gateway in website largely depends on the type of payment gateway you choose. Payment gateway integrations typically require the most man-hours and meticulous accuracy from the development team.

Romexsoft team is here to help. Whether you just need to add online payment to website or develop a larger web application with multiple features, our agile team would be happy to help with your project!